Expectations & Experiences: Borrowing and Wealth Management Fall 2019

Navigating Life's Important Financial Decisions

In the background of life's major milestones are big decisions involving borrowing and wealth management. The most recent Expectations & Experiences consumer trends survey from Fiserv reveals evolving preferences and attitudes regarding those important financial decisions.

Online and mobile loan applications are up

While still in its earlier stages, use of mobile (phones and tablets) to complete portions of the loan process are up significantly.

Survey question to those who applied for a mortgage/HELOC within the last 5 years: Did you complete any of the following aspects of this loan process online or through a mobile device? Select all that apply. Not all responses shown. Survey question to those who have applied for a loan in the last 2 years: For any loan(s) you applied for in the last 2 years, did you apply for any of these online, through a mobile app, or website?

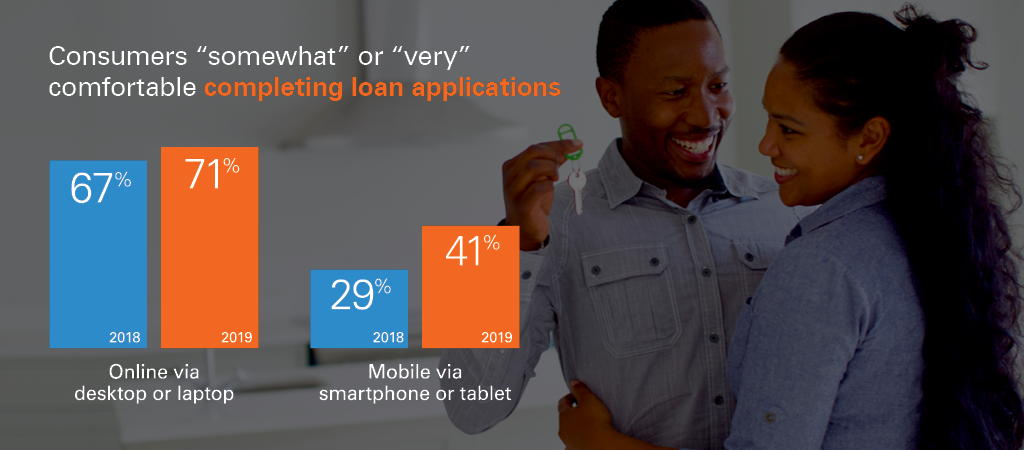

Comfort with completing mortgage loan applications on mobile is growing

Many people are comfortable with completing digital loan applications and comfort with mobile has increased drastically.

Survey question to those who have a mortgage or HELOC: Imagine that you are applying for a mortgage or HELOC. How comfortable would you be to complete a loan application in each of the following ways? Laptop or desktop? Smartphone or tablet?

The check is (probably) not in the mail

Use of mobile options for making mortgage payments has doubled since last year. Meanwhile, a preference for digital statements is now the norm.

Survey question to those who applied for a mortgage/HELOC loan within the last 5 years: Related to making payments on your loan, which of the following have you used? Select all that apply. / How would you most prefer to receive the bill for your loan payment?

Financial advisors seem out of reach for many

Even at relatively high income and asset levels, many people aren't using advisors. Why? Money and lack of understanding top the list.

Survey question to all qualified respondents: Do you currently work with a professional financial advisor to help you manage your finances (e.g., retirement planning, buying insurance or making investments)? / Survey question to those who do not work with an advisor: Why don't you work with a professional financial advisor? Please select all that apply.

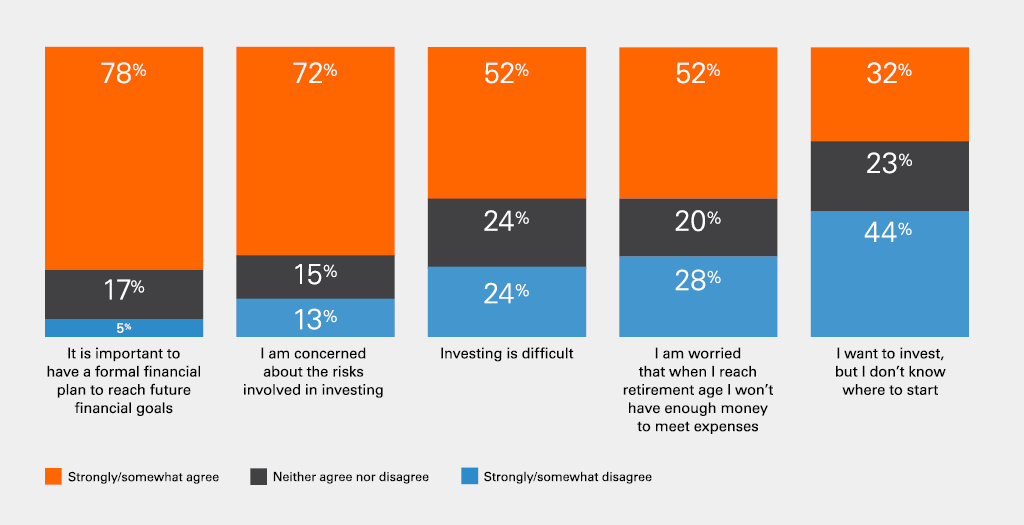

People value financial plans almost as much as they worry

It seems people know formal financial plans are important. Even so, many people worry that investing is risky, difficult or too hard to start.

Survey questions to all qualified respondents: Please indicate your agreement/disagreement with each of the following statements. / When it comes to financial advice, do you feel you are getting all the help you need?

What does the future of financial advising look like?

When it comes to financial advising, younger consumers are far more likely to go digital.

Survey question to respondents who invest their own money: With a virtual or “robo” advisor, you answer a pre-set list of questions on a website and automated computer algorithms provide you with recommendations on how to reach your financial goals. Are any of your current assets invested with the assistance of a virtual advisor?

Highlights of the key findings are available for download.

In-depth insights are available to Fiserv clients through the Boardroom Series.

About Expectations & Experiences

Conducted by The Harris Poll on behalf of Fiserv, Expectations & Experiences is one of the longest running surveys of its kind and builds on years of longitudinal consumer survey data. The survey provides insight into people's financial attitudes and needs, enabling organizations to design and drive adoption of services that improve consumer financial health, loyalty and satisfaction.

Money Movement Preferences Evolve

Research shows how and where consumers interact with financial services and predict future engagement capabilities.

The Changing Ways People Pay

The latest consumer trends on how people choose to pay bills, other people, and for goods and services.