The Point

Billing and Payment: Why Mobile Changes Everything

Life moves fast and people want their billing and payment experience to move just as quickly. That's why more and more consumers are using the mobile channel to quickly pay bills, receive alerts and get information about their accounts.

Being able to transact and pay bills with a swipe of a finger changes everything – for consumers and billers. Financial institutions and billers, some of whom were largely caught off guard when mobile accelerated, are now moving quickly to respond to changing consumer expectations and behaviors.

People expect billers to offer mobile bill pay on apps and mobile browsers, in addition to paperless e-bills, notifications and mobile due-date alerts. When they use mobile bill pay, they want the same simple, easy-to-use mobile experience they're used to with other service providers and retailers. Easy reading and navigation, with minimal need to resize, pan and scroll, enable a frictionless bill pay experience.

The Fiserv study provides insight into changing consumer behaviors and expectations – and helps billers develop effective strategies for mobile billing and payments. Key findings include:

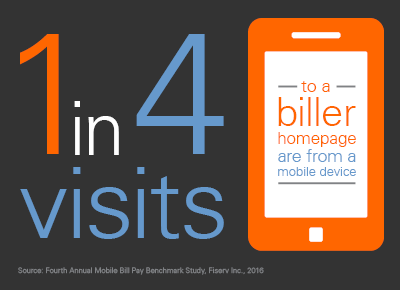

- Mobile visits to biller sites are up 42 percent

- Paying bills is the top reason consumers use mobile to visit a biller site

- 54 percent of billers offer mobile payments, up 68 percent

- 23 percent of billers plan to add mobile bill pay in six to 12 months

Implications for Billers

The ever-changing billing and payment landscape presents several challenges, all of which are impacted by the increasing use of mobile bill pay. The Mobile Bill Pay Benchmark study found 82 percent of billers cite security as a top pain point. Mobile adds more access points, an additional channel to manage and more payments to protect.

As adoption and usage of mobile payments grows, the number of card-funded payments is also increasing. Seventy-four percent of billers in the study now accept card-funded payments – and 78 percent expect mobile bill pay and presentment to spur growth of card-funded bill payments. These payments are more expensive to process due to interchange fees, especially credit and prepaid cards.

Billers are also concerned about the increasing cost of printing and mailing paper bills. The good news? Mobile due date alerting and anywhere, anytime payments can boost paperless e-bill adoption, and drive down late payments and customer care calls.

As the billing and payment environment grows more complex, billers will increasingly seek out firms that enable robust features and possess the knowledge to navigate key challenges. External partners can provide the expertise, breadth, and scale to help billers manage the highly complex billing and payment ecosystem.

To stay ahead of changing requirements, such as operating system updates, app requirements and screen sizing, work with trusted experts to help navigate billing and payment security, usability, complexity, and compliance.