The Point

Transforming the Mobile Banking Experience with Compelling, User-Friendly Design

Consumers expect an engaging, user-friendly experience on their mobile devices, whether shopping online, arranging travel or managing their finances. To meet the needs of today’s savvy consumers, Fiserv is focused on designing a transformative mobile banking experience – one that ensures a strong and clear focus on user needs.

Two-thirds of U.S. households own smartphones, and more and more of these consumers – 35 million and counting – use mobile devices to access financial services, according to the 13th Annual Fiserv Consumer Trends Survey. Mobile devices have become indispensable to the point where a growing number of consumers only use smartphones to go online, forgoing laptop and desktop computers – even tablets. More than other consumers, mobile-only users – or "mobivores" – are looking for a compelling user experience through their mobile devices, including mobile banking.

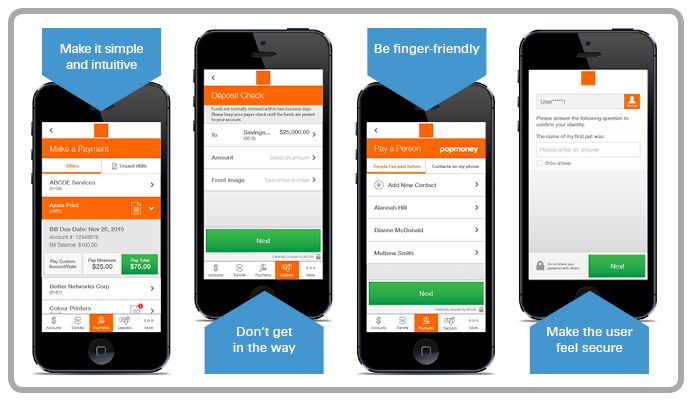

To accommodate the surge in mobile banking and provide the best, most compelling experience for all users, financial institutions must rethink the way they deliver mobile banking. The Fiserv design process is based on four key design principles and consumer preferences.

Make it simple and intuitive.

A meaningful layout with features and organized content makes things easy to find. The more choices users are presented with, the harder it is for them to choose. Where applicable, predetermined options minimize decisions and increase efficiency.

Don’t get in the way.

Users want to be able to focus on the task at hand without having their attention diverted to another task. Consumers need to be aware of where they are within the experience in a consistent and clear fashion. Information should be clearly displayed and next steps easily understood. Leading mobile apps are designed to deliver a fluid, seamless screen-to-screen experience, rather than illogical or disjointed navigation as the user moves from screen to screen. Fiserv user experience designers are challenged to ask, "If I make this change here, what will it affect elsewhere in the experience?"

Be finger-friendly.

Everything in the design must have a purpose and a function – no matter what size screen it’s displayed on. Improved touch optimization of screens and controls, as well as workflows that take fewer steps to complete, make navigation easier on a mobile device.

Make the user feel secure.

Consistency implies security, reliability and stability. A friendly interaction comforts users if they make a mistake. Users want feedback and help while they’re performing tasks, as well as clear and conversational terminology.

Easy-to-use, engaging digital experiences do not happen by accident. They are created through a disciplined, thoughtful approach to design, which incorporates consumer trends, expectations and research. Working with Fiserv, financial institutions can create personalized experiences that build confidence and trust with their customers and deliver an inviting, user-friendly mobile experience.

Interested in learning more? In this Boardroom Series session, Shirra Frost, director, Mobile Marketing, Fiserv, discusses how to attract and retain mobile-only consumers.