2018 Expectations & Experiences: Consumer Payments

Awareness Enhances the Payments Experience

Making consumers aware of the payments options their financial organizations offer, along with how to use certain services, can remove barriers to the adoption of payments technology. Education also can address concerns about security. Our research reveals opportunities for organizations to increase customer knowledge of services and security to improve the financial experience. Select highlights include:

- A lack of knowledge is a barrier to person-to-person payments use, with 23 percent saying they don't know how it works and 15 percent saying they don't know if their financial organization offers it.

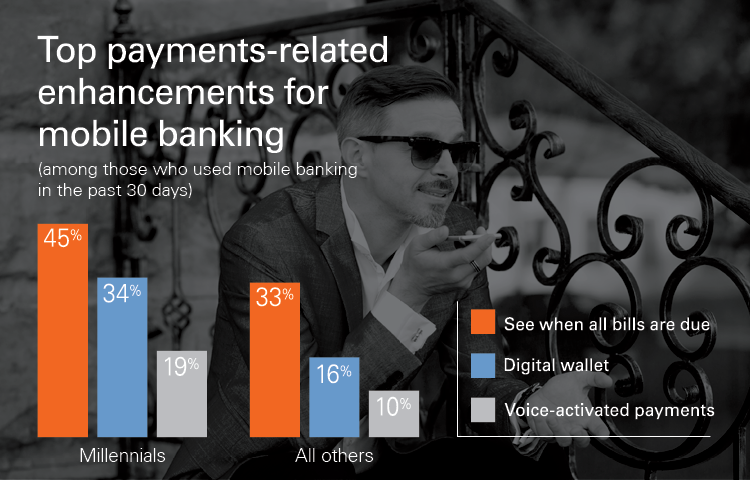

- One-third (33 percent) of consumers say there are mobile banking features they would like to use, but they don't know how.

- Among those who do not use mobile banking, 57 percent say they don't use the service because of security concerns. Meanwhile, 52 percent believe mail is a more secure way to receive bills than other methods.

For more information on people's views on payments, download our latest consumer trends research report, Expectations & Experiences: Consumer Payments.

About Expectations & Experiences

Conducted by The Harris Poll on behalf of Fiserv, Expectations & Experiences is one of the longest running surveys of its kind and builds on years of longitudinal consumer survey data. The survey provides insight into people's financial attitudes and needs, enabling organizations to design and drive adoption of services that improve consumer financial health, loyalty and satisfaction.

How People Feel About Financial Management

Expectations & Experiences: Household Finances provides insight into people’s personal finance routines, including how they perceive providers and services.

Enabling Life's Most Important Events

Expectations & Experiences: Borrowing and Wealth Management looks at the growing number of options available to help consumers make financial decisions and the influences on consumer behavior.