2020 Expectations & Experiences: Channels and New Entrants

People Are Ready for New Ways to Manage Money

These days, necessity and convenience are driving the ways people manage their finances. They don't visit the branch the way they once did and more people are likely to give online and mobile banking a try. Maybe using Siri or Alexa to pay a bill doesn't sound as far-fetched as it did in the past.

That could easily be a description of a post-COVID-19 world, but it's also an accurate characterization of the latest Expectations & Experiences consumer trends survey from Fiserv – with most responses collected in the first quarter of 2020 just before social distancing rules went into effect.

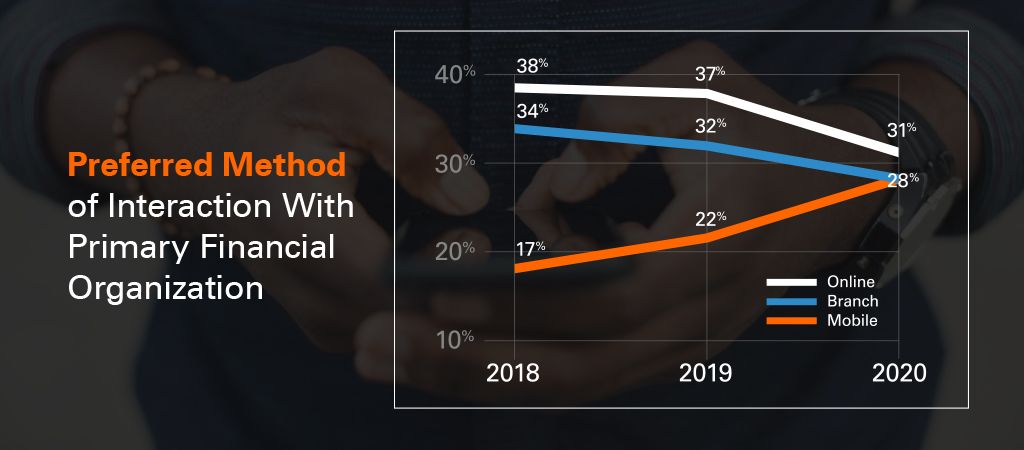

People now prefer mobile banking almost as much as online

Mobile preferences are way up and the gap between online banking, branch visits and mobile banking as the preferred way of interacting has nearly closed.

Survey question to all respondents: In which of the following ways would you most prefer to interact with your primary financial organization (FO)?

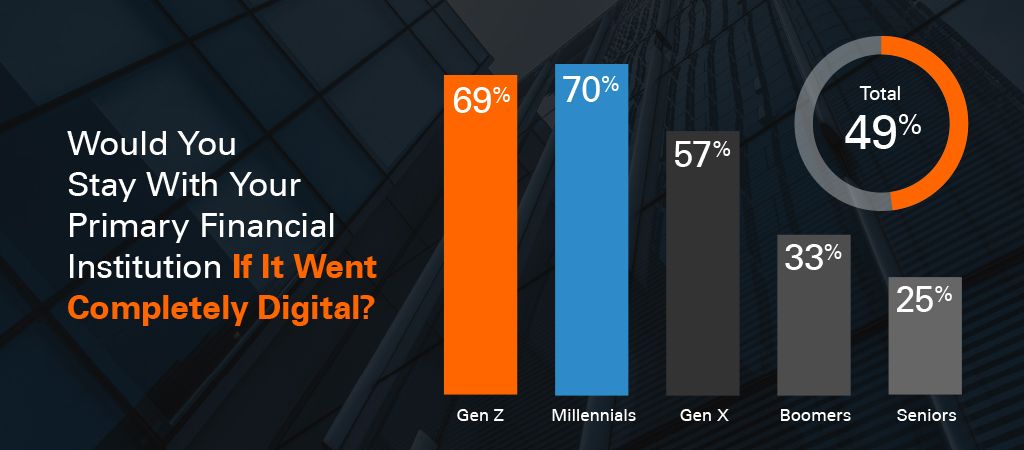

Virtual banking is especially appealing to younger consumers – and wealthier ones

When asked if they would stay with their primary financial institution if it switched to all virtual branches, nearly half (49 percent) said "yes." However, that response is largely driven by age, income and type of financial institution.

Survey question to all respondents: Imagine your bank notified you it was going all digital (that is, no branches), and the only way to access your account was through online and mobile banking. Customer service would still be available through both live chat and live phone calls during business hours. Would you use this digital bank as your primary financial institution?

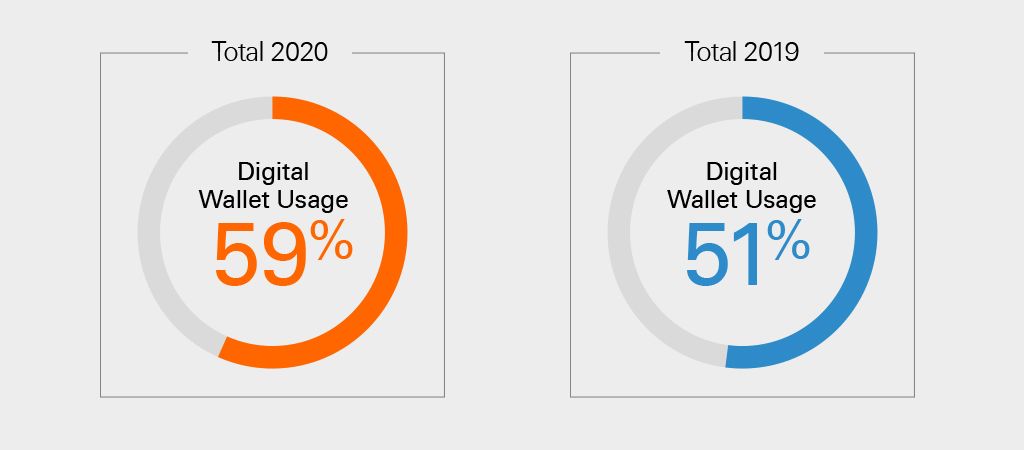

Digital wallet use is up

Digital wallet use continues to grow, from 51 percent in 2019 to 59 percent in 2020. Growth is highest among Gen X (from 56 percent to 66 percent), but also evident among millennials (74 percent to 81 percent) and boomers (33 percent to 40 percent).

Survey question to all qualified respondents: Have you used any of the following digital wallets to make a mobile or digital payment in the past 12 months? Please select all that apply

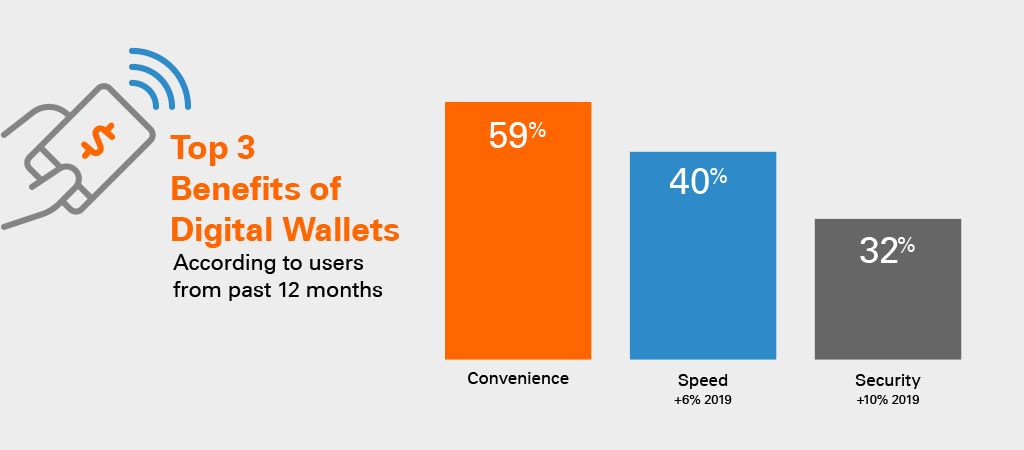

Digital wallet users say convenience a big reason they use the service

A majority of users say convenience is the reason for selecting digital wallets as a payment method, followed by speed and security. Of those, security shows the greatest year-over-year increase.

Survey question to those who used a digital wallet in past 12 months: For which of the following reasons, if any, have you used a digital wallet in the past 12 months? Please select all that apply.

Use of voice for banking and bill management grows

Use of voice-activated devices is now the norm, with two-thirds of all consumers now using some form of the service. It's still early for voice banking and bill management, but significant increases are seen over last year.

Survey question to those having used a voice-activated device: In the past 30 days, have you used a voice-activated device for any of the following functions? Please select all that apply.

For paying bills, people choose financial institutions over other types of companies

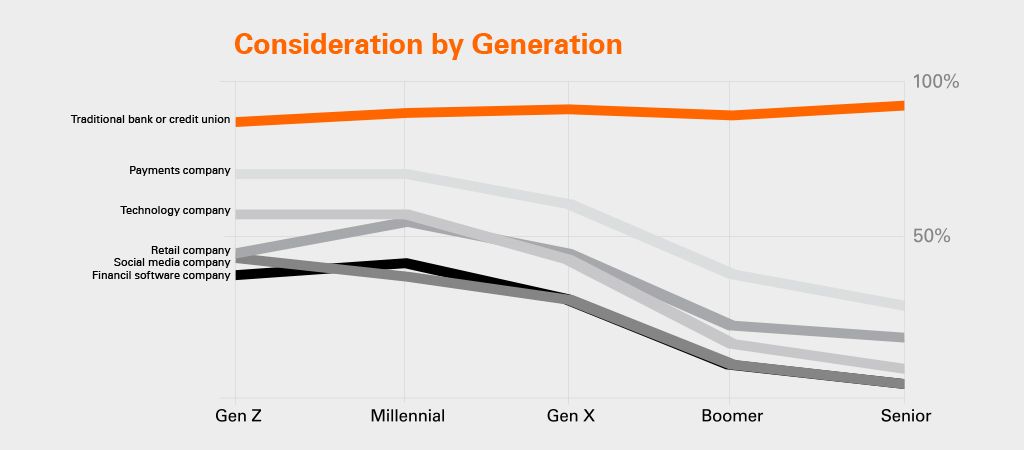

Consumers say they're most likely to use traditional banks and credit unions for bill payments, with more than 8 in 10 saying they are likely to use (or continue to use) their primary financial organization. Generally speaking, willingness to use a nontraditional company, such as a retailer or technology company, for bill pay is closely linked to age.

Survey question to those consumers involved in bill pay: How likely are you to use (or continue to use) each of the following to pay household bills, if it was available?

Highlights of the key findings are available for download.

In-depth insights are available to Fiserv clients through the Boardroom Series.

Need help? Contact communities@fiserv.com if you are a Fiserv client and need access to the Boardroom Series community.

About Expectations & Experiences

Conducted by The Harris Poll on behalf of Fiserv, Expectations & Experiences is one of the longest running surveys of its kind and builds on years of longitudinal consumer survey data. The survey provides insight into people's financial attitudes and needs, enabling organizations to design and drive adoption of services that improve consumer financial health, loyalty and satisfaction.

The Rise of Digital Payments

Consumers want seamless, on-demand financial services experiences – and more people than ever are turning to digital payments options to get them. According to the latest Expectations & Experiences consumer trends survey from Fiserv, the drive to digital is showing no signs of slowing down.

Money Management On-Demand and On-the-Go

They may not always be aware of it, but people make decisions about how to move and manage money all day, every day. The latest Expectations & Experiences consumer trends survey from Fiserv shows how consumers' financial decision making is evolving.