Frontier Reconciliation

Improve operational efficiency, enable compliance and mitigate risk with enterprise reconciliation and certification

Even with strict regulations for accurate and compliant financial reporting, many organizations still use manual or semi-automated processes for reconciliation and certification. Such processes can result in errors, operational inefficiency and lack of visibility into the numbers during certification.

A comprehensive end-to-end reconciliation and certification solution, Frontier™ Reconciliation from Fiserv forms a complete account reconciliation picture across your enterprise that makes exceptions instantly visible and reduces manual interventions. Workflows fully automate labor-intensive processes and ensure compliance with corporate and regulatory controls.

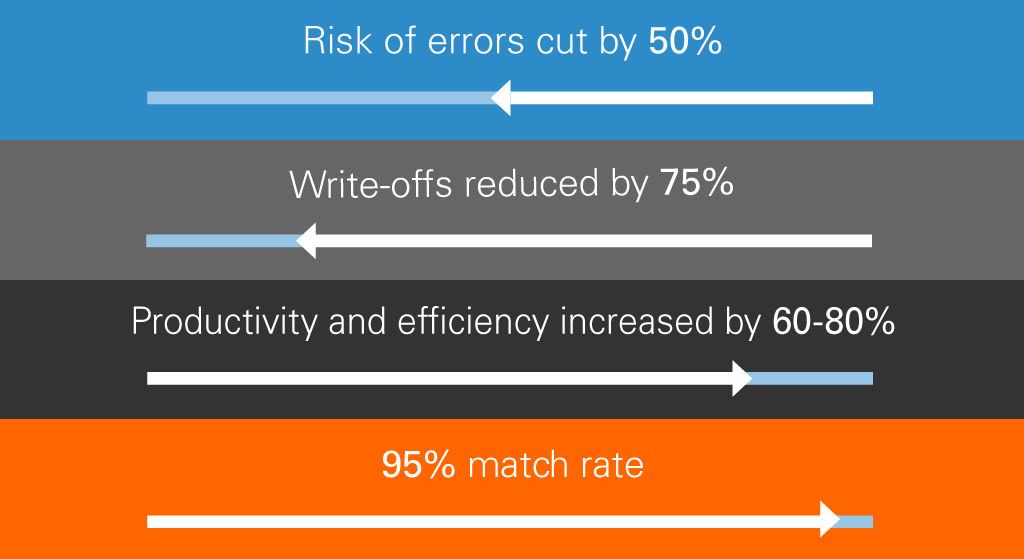

But reducing errors and write-offs is only part of the picture. By minimizing the need for manual research or interventions during the reconciliation process, organizations can achieve major efficiency improvements and lower operational costs while enabling staff to perform more value-added work.

A More Accurate Account Reconciliation Process Enhances Operational Efficiency While Reducing Risk

More accurate data in the financial close process

Increased operational efficiency and regulatory compliance

Greater data visibility and transaction-level exception detection

Process larger volume of transactions at scale

Facilitate all transaction and account types

Frontier Reconciliation minimizes the risk of financial misstatement with transaction-level matching – on one-to-one, one-to-many and many-to-many levels – and a comprehensive audit trail.

Designed as a data-agnostic bank reconciliation software system, Frontier Reconciliation can ingest data from virtually any source and in any of the most commonly used formats to identify and resolve exceptions with speed and accuracy.

Frontier Reconciliation works seamlessly with all core platforms as well as general ledger solutions including Prologue™ Financials from Fiserv.

Once a reconciliation is fully certified, it's locked down and it can't be changed anymore, and that really gives more peace of mind for our auditors and our regulators.

– Dana French, SVP, Finance Operations, Wintrust Financial

Watch the video to learn how Wintrust Financial centralized reconciliation for time savings and productivity gains.

Automated Reconciliation Drives Growth and Efficiency

To learn more, download the Top Five Reasons to Automate Reconciliation for Growth and Efficiency infographic.

Frontier Reconciliation and certification connects core applications with a data-agnostic management system to automate and simplify your financial close across the entire reconciliation lifecycle

Frontier Reconciliation

- Data Management

- Transaction Matching

- Exception/Case Management

Frontier Reconciliation:

Account Certification

- Integrated Approval Workflow

- Fully Traceable Audit Trail

Frontier Reconciliation:

Workflow Manager

- Automated Exception Management

- Identify, Route, Resolve Exceptions

Frontier Reconciliation:

Transfer Manager

- Simplified Change Control

- Detailed Audit Control

- Business Rules System

- Automated System Updates

Frontier Reconciliation:

Archival

- Unlimited Historic Data Repository

Learn More

Frontier Reconciliation takes an enterprise approach to reconciliation and exception management, creating an optimal environment for effective risk management, unprecedented data visibility and operational efficiency.

Frontier Reconciliation for Insurance

In addition to serving financial institutions, Frontier Reconciliation for insurance can transform financial control transformation in your insurance organization to protect your bottom line, mitigate risk and enhance regulatory compliance.

And as the insurance industry continues to undergo increased scrutiny and regulatory oversight, the need for effective reconciliation controls has never been more imperative.

Six Ways Automated Reconciliation Drives Your Back Office Forward

Nearly every step of the account reconciliation process can be improved with the right technology. Learn about six key benefits that financial institutions can expect to achieve from automating their account reconciliation processes.

See How Frontier Reconciliation Has Helped These Clients

Growing Bank Goes Paperless With Automated Reconciliation and Certification

Northway Bank accelerated their process by 60 to 75 percent, with full audit trails, by choosing Frontier Reconciliation to handle all accounts on a single platform.

First Federal Bank Overcomes Growing Pains and Manual Processes With Frontier Reconciliation

Rapid acquisition growth and increased transaction volume overwhelmed the bank’s manual reconciliation process. This case study explores the solution and results.

Meritrust Credit Union Leverages Frontier Reconciliation for More Efficient Use of Time and Accounting

Meritrust Credit Union dramatically grew their asset base and cut processing time in half with Frontier Reconciliation. Watch the video to learn about their success.

Insights

How Automated Reconciliation Helps Employees

Learn how automated reconciliation not only can help remove many of the manual, routine tasks associated with reconciliation and month-end close, but also enable a remote workforce and improve employee retention.

Building the Business Case for Automated Reconciliation and Certification

This white paper outlines the key benefits of automated reconciliation including five steps to start building a business case for automation.

Transaction-Level Matching – The Key to Effective Reconciliation

With true transaction-level matching, you can see the numbers behind your financial statements and identify specifically where the exceptions are, which minimizes financial exposure.