Direct Bank

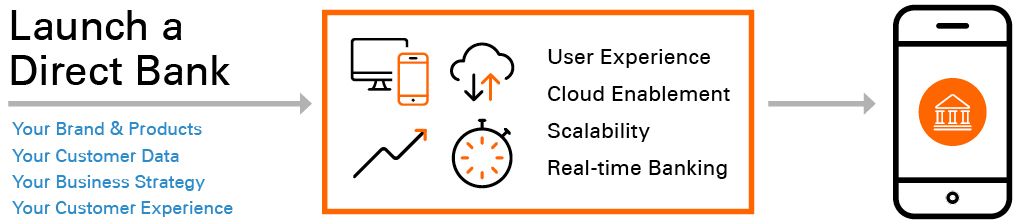

When launching branchless direct banks, community banks, de novos and Fintechs need to focus on a few key areas. They need the ability to get up and running quickly and cost-effectively, the flexibility to deliver unique and compelling experiences and the agility to introduce new innovations at a rapid pace.

Overview

It's never been easier to offer financial services through a digital platform, with no brick-and-mortar presence. Advancements in API, cloud, digital and real-time technology have intersected with the growing desire for fast, easy and mobile-first capabilities. These expectations are especially strong among the next generation of consumers who are digital natives.

A variety of banks and Fintechs are moving fast to meet these expectations by creating digital-only enterprises, or direct banks. Some are traditional financial institutions launching separately branded direct banks to drive deposits, some are de novos with a vision for digital differentiation and others are Fintechs looking to expand their disruptive digital offerings with banking services.

Direct banks enjoy an obvious cost advantage that enables them to offer more attractive pricing than brick-and-mortar banks.

– Direct Banks and the Future of Consumer Banking, TNS

Launching a digital-only bank offers huge opportunities to adapt and prosper in a changing landscape. Those that take this approach need speed, agility, openness and the ability to create a unique and seamless digital experience. With Fiserv, you can innovate and differentiate while leveraging the capabilities of a market-proven core banking solution.

Features

Continuous, real-time

processing

Market-tested processing

and compliance capabilities

Flexible deployment options,

including cloud

Real-time notification

cloud streams

Robust API layer with

standardized APIs

Comprehensive array of

pre-integrated surround solutions

How Fiserv Can Help You

Fiserv offers a flexible direct bank solution designed to meet the unique needs of Fintechs, community banks and de novos launching direct banks.

- Fintechs that want to weave banking services into the experience they already offer can leverage the proven capabilities of our direct bank core solution to bring financial services to market quickly. Working with Fiserv, they can feel assured they are addressing the basic requirement of banking, including regulatory compliance. Fiserv open APIs enable Fintechs to own the customer experience, connecting all required capabilities and creating a truly compelling digital experience

- De novos looking to launch a digital-only bank can use the turnkey, direct bank core solution from Fiserv to establish the new bank with rapid deployment. Using this solution, digital de novos can be well-positioned to grow deposits, make loans and serve customers without the expense of brick-and-mortar branches. They have access to a full array of back-office and digital capabilities required to open and run a direct bank

- Community and regional banks are seeking to win the race for deposits and fuel new loans by launching a separately branded digital bank – are able to tap into markets outside their physical footprint. Fiserv offers a direct bank solution that plugs into the bank's existing core and infrastructure, supporting a quick launch, while leveraging solutions the bank's team already knows and understands. Banks can attract new customers by using Fiserv APIs to create a digital experience that stands out from the competition

Have a question for us?

For more information about Direct Bank and other Fiserv solutions, call us at 800-872-7882 or click below.

Contact Us