2018 Expectations & Experiences: Channels and New Entrants

Consumers Are Open-Minded

People depend on digital channels to manage their financial lives, but they continue to visit the branch. Those who use digital solutions – including new innovations, such as voice-activated banking – are using them more than ever. And consumers are increasingly comfortable with using new kinds of nonfinancial providers to complete different types of transactions. Put simply, they're open to anything, so long as it keeps pace with their lives. Highlights include:

- More than half (56 percent) of consumers prefer to interact with their financial organizations via digital, compared to 34 percent who prefer branch interactions.

- Only 15 percent of people express interest in banking via voice-activated devices. However, current users significantly increased their usage from 2017 to 2018 (from 7.7 to 11.2 transactions per month).

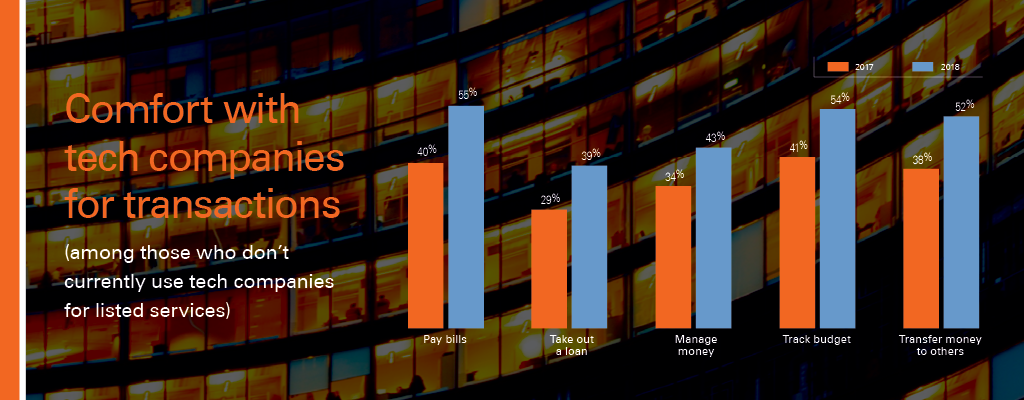

- Consumers' comfort with using nonfinancial companies to perform banking functions has increased. For example, in 2017, 40 percent of people said they would be comfortable using a technology company to pay bills as compared to 55 percent in 2018.

For more information on how people manage finances and attitudes toward new providers, download our latest consumer trends research report, Expectations & Experiences: Channels and New Entrants.

About Expectations & Experiences

Conducted by The Harris Poll on behalf of Fiserv, Expectations & Experiences is one of the longest running surveys of its kind and builds on years of longitudinal consumer survey data. The survey provides insight into people's financial attitudes and needs, enabling organizations to design and drive adoption of services that improve consumer financial health, loyalty and satisfaction.

Awareness Enhances The Payments Experience

Expectations & Experiences: Consumer Payments highlights consumers’ use of different payment methods and reveals their perceptions of payments technology and barriers to adoption.

How People Feel About Financial Management

Expectations & Experiences: Household Finances provides insight into people’s personal finance routines, including how they perceive providers and services.