Comparalytics

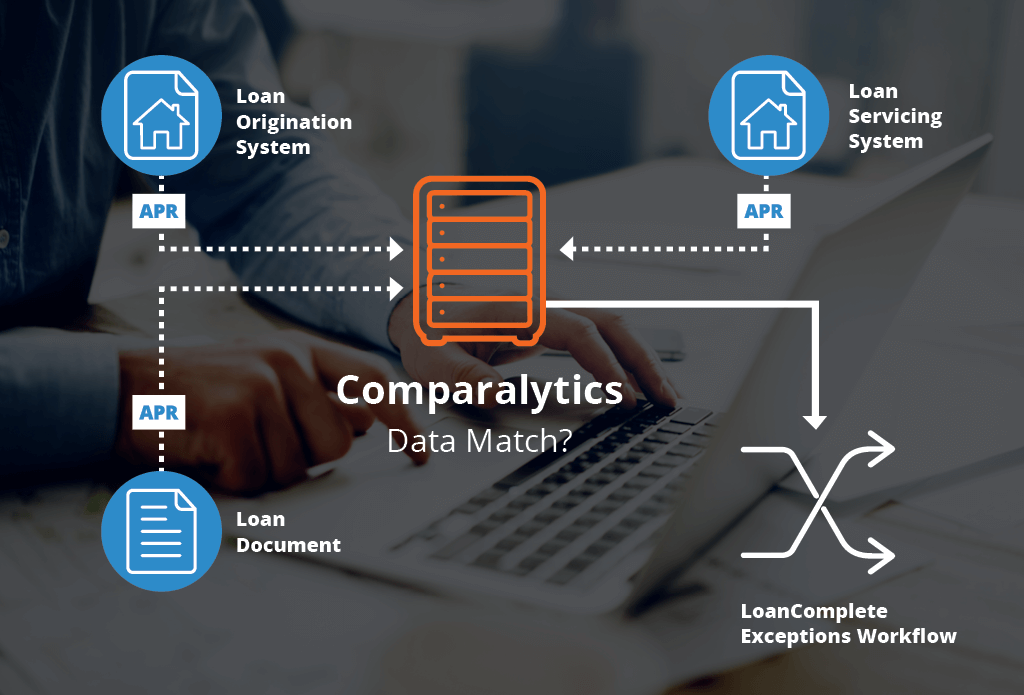

Lenders and servicers use Comparalytics™ from Fiserv, part of the LoanComplete™ solution suite, to assist them in automating quality and compliance checkpoint audits, helping them gain the accuracy, efficiency and confidence needed to save their institutions time and money.

Overview

Comparalytics helps you improve compliance while reducing costs risks of penalties and repurchases. It helps you confirm that your loan files are accurate, complete and saleable.

Using Comparalytics, you can reduce your operations team's need to perform time-consuming, manual data review audits during post-close and servicing system onboarding. Using the system helps speed and automate these reviews, increase efficiency, reduce costs and deliver high quality loan files. Compared to manual auditing, automation with Comparalytics helps increase staff efficiency.

Comparalytics helps you improve compliance while reducing costs risks of penalties and repurchases. It helps you confirm that your loan files are accurate, complete and saleable.

Using Comparalytics, you can reduce your operations team's need to perform time-consuming, manual data review audits during post-close and servicing system onboarding. Using the system helps speed and automate these reviews, increase efficiency, reduce costs and deliver high quality loan files. Compared to manual auditing, automation with Comparalytics helps increase staff efficiency.

Benefits

Comparalytics can help your institution:

- Improve data accuracy

- Reduce costly and error-prone manual reviews

- Increase the value of loan portfolios for resale

- Minimize data issues associated with foreclosures, buybacks and consumer complaints

- Decrease costs with improved processor efficiencies

Have a question for us?

For more information on Fiserv solutions, call us at 800-872-7882 or click below.

Contact Us