LoanComplete

LoanComplete™ from Fiserv automates mortgage loan processing and servicing tasks, giving mortgage originators and servicers greater control and helping streamline critical loan processes to improve profitability and business operations.

A life-of-loan solution, LoanComplete complements your existing loan origination system workflow, servicing and compliance systems, helping you process and service more loans, at less cost and risk.

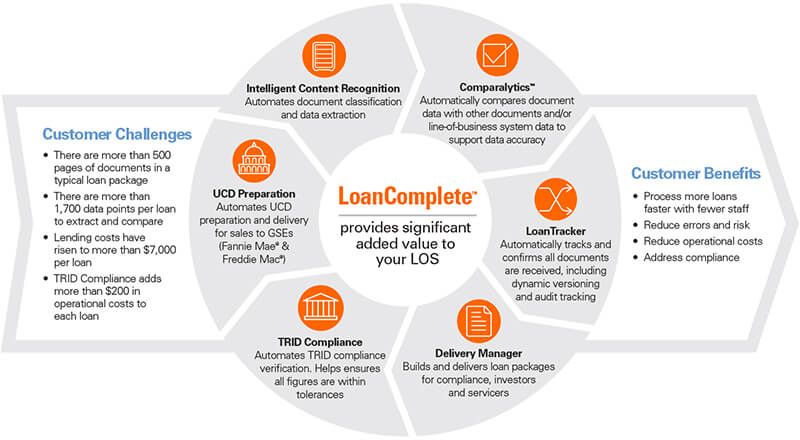

Address Data Quality and Compliance Challenges so You Can Focus on Growing Your Lending Business

For originators, LoanComplete automates many pre- and post-close processes, including quality assurance and compliance audits, to help you improve loan quality and better address compliance requirements like TRID and HMDA. LoanComplete helps you avoid risk of repurchase, fines, and penalties while delivering a complete, saleable and serviceable loan package.

Automate and Accelerate Your Loan Boarding and Enjoy Better Data Quality and Reduce Compliance Risk

For servicers, LoanComplete allows you to automate and accelerate loan boarding and streamline loss mitigation, bankruptcy and foreclosure referral processes. It also helps reduce operational costs and risk.

LoanComplete lets you automate tasks like document classification, data extraction, data quality verification, workload queuing, reminders for critical time-sensitive dates and data upload to servicing systems. To learn how LoanComplete simplifies loan servicing, read the LoanComplete Mortgage Servicing Fact Sheet.

LoanComplete Modules

LoanComplete is comprised of a number of different modules to help you address specific mortgage origination and servicing needs. These modules may be purchased together or individually.

Intelligent Content Recognition

Automates loan document classification, data extraction and archiving to decrease labor costs, improve loan file quality and reduce risk.

Comparalytics

Automates document and data quality and compliance checkpoint audits, helping increase accuracy and efficiency while saving time and money. Helps ensure loan packages are accurate, complete and saleable.

LoanComplete: Loan Tracker

Categorizes and tracks all loan-related content through the entire lending process.

LoanComplete: Delivery Manager

Provides an easy, efficient, compliant and cost-effective way for post-closing departments to deliver complete loan packages electronically to external organizations.

LoanComplete: Quality Check for TRID Compliance

Automates pre- and post-close TRID compliance checking by comparing more than 1,600 data fields between multiple documents using an advanced rules engine to help ensure TRID tolerance thresholds are not violated.

LoanComplete: Quality Check for UCD Preparation and Delivery

Fills the gaps in most origination systems by checking for discrepancies between data and documents and manages feedback messages and eligibility exception resolution. Ensures a complete and compliant UCD with required documentation.

LoanComplete helps you:

- Confirm completion, quality and continuity of data and documents

- Accelerate and standardize origination and servicing processes

- Lower risk while helping meet demanding regulatory compliance requirements

- Improve staff productivity while reducing costs

- Enable better customer service and satisfaction

Have a question for us?

For more information on Fiserv solutions, call us at 800-872-7882 or click below.

Contact Us