LoanComplete: Quality Check for Uniform Closing Dataset (UCD)

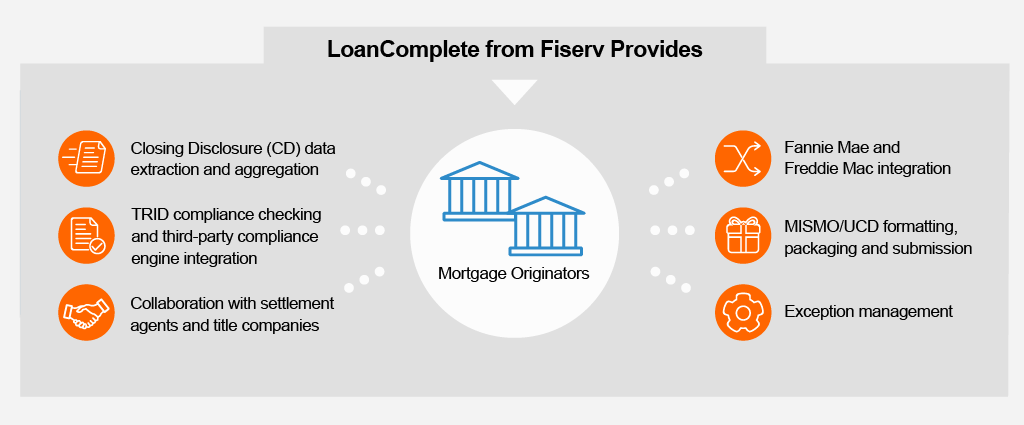

Lenders use LoanComplete™ Quality Check to complement their loan origination systems (LOS) and help automate their Uniform Closing Dataset (UCD) preparation and delivery.

Overview

LoanComplete Quality Check helps you fill UCD gaps found in most loan origination systems. It checks for discrepancies between data and documents, and manages feedback messages and eligibility exception resolution. The solution also performs seller closing disclosure data collection and validation and can address unique processes for multi-channel lending.

Address a wide range of UCD-specific needs with LoanComplete Quality Check. It can be set up to automatically extract more than 1,700 data points from borrower and seller closing disclosures, and performs pre-delivery quality control checks to help you ensure data in the UCD XML file matches data on the closing disclosure. LoanComplete formats required UCD data into MISMO/UCD format and combines required documentation in PDF format.

LoanComplete for Uniform Closing Dataset (UCD) Preparation and Delivery

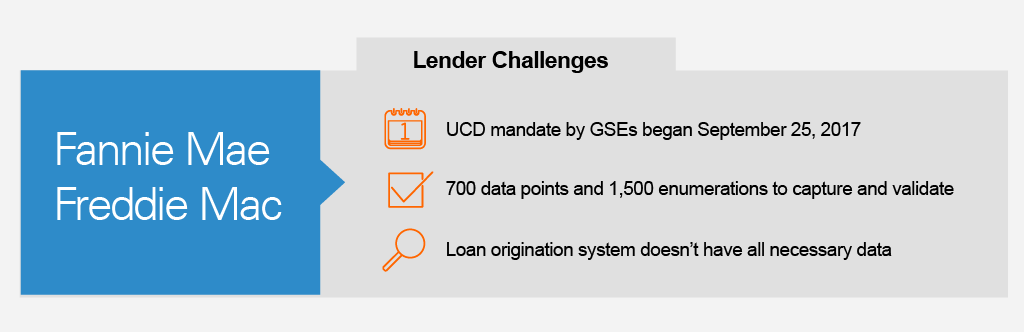

For Selling to Government-Sponsored Enterprises (GSEs)

LoanComplete Quality Check helps you ensure that the closing disclosure delivered to Fannie Mae or Freddie Mac is accurate, meets UCD requirements that went into effect on September 25, 2017 and TRID compliant. It includes an interface with third-party compliance systems and can be set up to provide a B2B direct interface with Fannie Mae and Freddie Mac to automate delivery and collect eligibility issues.

Benefits

Using LoanComplete Quality Check:

- Simplifies UCD preparation with automatic extraction of buyer and seller CDs

- Accelerates the delivery process using direct portal integration to reduce risk and cost

- Improves quality and reduces errors by comparing UCD data to final CD

- Increases productivity by providing GSE feedback routing, tracking and reporting

- Ensures compliance by using MISMO, CFPB and GSE standard file formats

- Offers peace of mind with Freddie Mac certification

Have a question for us?

For more information about LoanComplete: Quality Check for Uniform Closing Dataset (UCD) and other Fiserv solutions, call us at 800-872-7882 or click below.

Contact Us